Singapore Private Property Outlook 2019 Part 1

In Singapore’s short history, some people became millionaires by timing the property market correctly. Yet there were also many more people who have lost entire fortunes by entering the property market at the wrong time. In one of the previous insights that we shared, we mentioned that the long-term property trend is going up.

However, there is also a saying that the market can stay irrational longer than you can stay solvent. This means that if one cannot survive the short-term volatility, they will not be able to see the fruits of their labour. In our special three-part video series, we will discuss where we think the Singapore property market will head towards in year 2019. In summary, it is our view that there is more short-term downside ahead for Singapore private property prices.

Prices nearing all time highs

Firstly, we need to recognise that prices are nearing an all-time high.

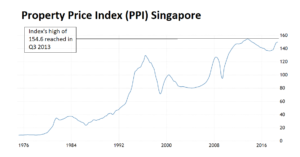

Property prices are nearing all time high in Singapore which is evident from Property Price Index (PPI)

We can see this from the PPI, and this is a price level of huge significance. It is much harder to break through an all-time high price. The logic is this: If you are a buyer who purchased a private property at a high in 2013, you would have been sitting on a loss for 5 agonising years. When property prices finally catch up to your breakeven price, you would be more inclined to sell. This will increase the supply of private property on the resale market.

At the same time, if prices are at an all-time high, the pool of buyers will also decrease because not many buyers will dare to buy their private properties at an all-time high. With larger supply and lower demand, it explains why prices tend to reject from prior highs. However, this point is under the assumption that there are no other sudden demand factors.

Soft rental market for past 5 years

The next point is that rentals have been mostly flat for the past 5 years.

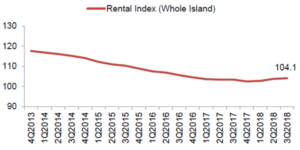

Rentals have been falling and staying low for the past few years and do not look set to bounce within the foreseeable future, from the Rental Price Index (RPI).

There are many property investors that take up mortgages to purchases multiple properties. This is done with the intention of renting them out. The rent collected is then used to pay the monthly instalments on the mortgages. With falling rentals, it will become harder to sustain such a method of property investment. This means that some of such property investors may be forced to offload their properties if and when they are unable to find tenants at a sustainable rental price. Less people will also adopt such a method of property investing when they see that the prevailing rentals are unsustainable. In short, lower demand and higher supply again.

Rising Interest Rates

The last point we will make in this video is the most important one that significantly affects property purchase decisions. Interest rates in Singapore, known as Singapore Interbank Offered Rate, have been going up and will continue to go up in the near future.

SIBOR looks set to go up in tandem with US Federal Funds Rate.

SIBOR is closely correlated to the U.S Federal Funds rate, which will has been indicated to rise in the coming years.

With higher interest rates, less people will be able to afford the more expensive monthly repayments. Overleveraged property owners will also find it harder to refinance when their lock-in period expires. Many of such property owners who took too many loans will be forced to sell off their properties. This happens when they are unable to keep up with the higher interest rates. The situation will be worsened if they are unable to find tenants to rent out their properties as mentioned previously.

In the next post, we will discuss two other factors that may further drive down property prices in Singapore. Till next time! This is Isaac, keeping property real for you. If you enjoy the explainer video, please subscribe to our Youtube channel and click on the bell icon to keep notified of our new content!